Why investing early in your ISA will reap rewards

The new tax year means that all tax favourable allowances begin again. Whilst it’s possible to make your ISA investment any time during the year, not only does it make sense to make your annual contribution as early as possible in the new tax year but research shows that it will give you a much better return than waiting until nearer the end of the tax year.

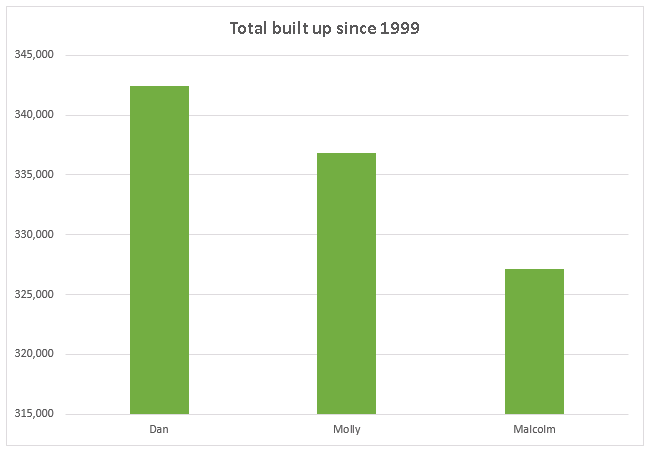

To show you the benefits we have three people that invest into their ISA differently:

Early Doors Dan – he invests into his ISA on the first day of each tax year

Monthly Molly – she makes a regular monthly contribution into her ISA

Last Minute Malcom – he invests into his ISA on the last day of the tax year

Assuming that each of them invested the maximum ISA allowance each tax year since ISAs have been available (1999) they would have paid in a total of £186,560. All of the ISAs were invested into the FTSE All-Share Index (with dividends reinvested). You can see from the following chart the outcomes:

This shows that by maximising the tax efficient growth of an ISA, as early as possible in the tax year, helps the capital grow faster. Dan achieved the best returns. His ISA is worth £342,445.

Investing monthly is a great option especially if a lump sum isn’t available and Molly’s results are not that much lower. Her ISA is worth £336,875, which is only around £5,500 less than Dan’s, so making the most of the fluctuating prices, benefits in the long term.

Poor old Malcolm missed out on £15,300 extra growth by investing on the last day of the tax year. His ISA is worth £327,141. Foregoing the tax free growth throughout the year makes a significant difference to the returns.

With interest rates continuing to be low, the best way to make the most of your ISA allowance is to invest early in the tax year into a stocks and shares ISA that matches your attitude to risk. If you don’t have a lump sum then drip feeding money on a regular basis will still build you a nice nest egg for the future. Best of all any money you draw from an ISA is tax free.